Leverage in Forex Trading: A Double-Edged Sword

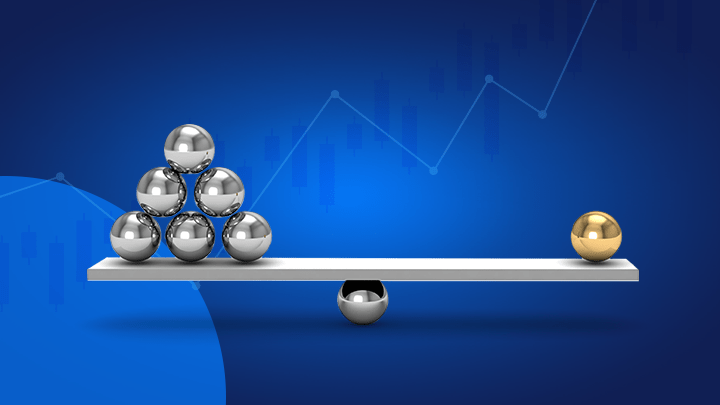

The foreign exchange market, also known as forex, is a dynamic and exciting arena for investors. One of the key features that distinguishes forex trading from other investment options is leverage. This concept allows traders to control a much larger position in the market than their initial investment would typically allow. While leverage can be a powerful tool for magnifying profits, it’s crucial to understand its mechanics and the inherent risks involved.

Understanding Leverage: Borrowing to Amplify Potential

Imagine you have $1,000 and believe the Euro (EUR) will appreciate against the US Dollar (USD). In a traditional stock purchase, you could only buy $1,000 worth of Euros. However, forex brokers offer leverage, essentially acting as a lender. With a 10:1 leverage ratio, you could control a position ten times larger, buying €10,000 worth of Euros using your $1,000 deposit as collateral.

The Leverage Equation: Calculating Your Exposure

The leverage ratio is represented as a multiplier. A 10:1 leverage ratio signifies that for every $1 you invest, you control $10 in the market. Here’s a formula to calculate your total exposure:

Total Exposure = Leverage Ratio * Initial Margin

Total Exposure represents the total value of the currency position you control. Leverage Ratio is the multiplier provided by the broker (e.g., 10:1, 50:1). Initial Margin is the deposit you put up to control the position (e.g., your $1,000).

In our example:

*Total Exposure = 10 (Leverage Ratio) * $1,000 (Initial Margin) = €10,000

The Magnifying Effect: Leverage and Profits

If your prediction is correct and the EUR strengthens against the USD, you’ll see magnified profits. Even a small appreciation in the Euro’s value translates to a larger percentage gain on your initial investment due to the leverage.

Continuing our example, let’s say the EUR appreciates by 5% against the USD. Without leverage, your $1,000 investment would yield a $50 profit. However, with the €10,000 position you control due to leverage, a 5% appreciation translates to a €500 profit, which is equivalent to a $500 profit when converting back to USD. This represents a 50% return on your initial $1,000 investment.

The Magnifying Effect (Part Two): Leverage and Losses

The double-edged nature of leverage becomes evident when your prediction goes awry. If the EUR depreciates against the USD, your losses are also amplified. A small decline in the Euro’s value can result in a significant loss on your investment.

In our example, if the EUR depreciates by 5% against the USD, you would incur a €500 loss, which translates to a $500 loss upon conversion. This represents a 50% loss on your initial $1,000 investment, highlighting the substantial risk associated with leverage.

Managing Leverage Responsibly: Key Considerations

Forex trading with leverage can be a rewarding experience, but it requires a prudent approach. Here are some key considerations to keep in mind:

- Risk Tolerance: Assess your risk tolerance before employing leverage. Higher leverage ratios magnify both profits and losses. Start with lower leverage if you’re a new trader.

- Stop-Loss Orders: Utilize stop-loss orders to automatically exit a position when it reaches a predetermined price point, limiting potential losses.

- Maintain Margin Requirements: Forex brokers require you to maintain a minimum margin in your account to uphold leverage. Falling below this threshold can result in a margin call, forcing you to deposit additional funds or face liquidation of your position.

- Start Small: Begin with a small investment amount, especially when using leverage, to minimize potential losses while you gain experience.

Leverage: A Tool to Be Wielded Wisely

Leverage is a powerful tool that can significantly enhance your returns in forex trading. However, it’s equally important to acknowledge the amplified risks involved. By thoroughly understanding leverage, employing sound risk management strategies, and approaching the market with discipline, you can leverage this concept to your advantage and navigate the exciting world of forex trading.